Trading isn’t just about picking the right direction, it’s about timing your entries with precision. That’s where different order types come into play, and one that often gets overlooked by beginners is the buy stop order. Designed to catch price breakouts and momentum moves, a buy stop can be a powerful tool when used correctly.

But what does a buy stop mean, and why do so many traders use it, particularly in forex markets? If you’ve ever wondered what is a buy stop in trading, or more specifically, what is buy stop in forex, this guide is for you.

Whether you’re using advanced trading platforms like cTrader by FXPro, or just starting to explore more complex strategies, understanding how a buy stop works is essential. In this article, we’ll walk you through the buy stop definition, show you how to place a buy stop, and offer real-world buy stop examples so you can see this order type in action.

Let’s dive in and get buy stop explained in full detail.

Buy Stop Definition

A buy stop is a type of pending order used in trading to enter the market at a price higher than the current market price. The order becomes active only when the market reaches the specified level, at which point it turns into a market order and is executed at the next available price.

In simple terms, a buy stop is placed above the current price because the trader believes the asset will continue to rise once it breaks through a certain level. This makes it especially useful for breakout strategies, where traders want to catch upward momentum as it happens.

So, what does a buy stop mean in practice? It means you’re setting an automatic trigger to buy, but only if the market proves your setup by moving in your expected direction.

If you’re wondering what does a buy stop mean or what is a buy stop in trading, the key idea is this: you’re not buying now — you’re preparing to buy if and when the market climbs to your chosen level.

This order type can be found across various markets, including forex, stocks, and commodities, and it’s commonly used by traders who want to enter positions as part of a trend-following or breakout strategy.

What is a Buy Stop Order in Forex Trading?

In forex trading, a buy stop order is commonly used by traders who expect a currency pair to gain strength once it breaks above a certain price level. The idea is to catch the upward momentum as the market continues to move in that direction.

A buy stop order in forex is placed above the current market price. Once that price is reached, the order is triggered and executed as a market order, buying the currency pair at the best available price. This helps traders enter long positions only when the market shows confirmation of an uptrend.

For example, if EUR/USD is currently trading at 1.0800 and a trader believes that breaking above 1.0850 would signal a strong bullish move, they might place a buy stop order at 1.0850. If the price reaches that level, the buy stop is activated and a buy trade is opened.

This kind of order is especially useful in volatile markets where price can move quickly. It allows traders to plan their trades in advance and avoid constantly monitoring the screen, waiting for the right moment to enter.

So when asking what is buy stop in forex or what does buy stop mean in forex, the answer is simple: it’s a way to enter a trade as the market breaks out, with the goal of riding the trend early and avoiding premature entries.

How Does a Buy Stop Work?

A buy stop works by telling your trading platform to automatically enter a buy position once the market reaches a specific price above the current level. It doesn’t execute immediately. Instead, it waits for the market to move in your favor before triggering the order.

Here’s a step-by-step breakdown of how a buy stop order works:

- You choose an entry price that is higher than the current market price.

- You place a buy stop order at that price.

- The order remains inactive (pending) until the market reaches or exceeds your chosen price.

- Once triggered, the order becomes a market order and is filled at the best available price.

This approach is often used in breakout trading strategies. Instead of guessing when a breakout might happen, a buy stop lets you enter the trade only if the price breaks through a resistance level, confirming the move before you commit.

For example, if GBP/USD is trading at 1.2600 and you believe a breakout will occur at 1.2650, you can place a buy stop at 1.2650. If the price rises to that level, your order is executed and you’re in the trade.

Understanding how a buy stop works can help you avoid premature entries and ensure you only trade when your strategy conditions are met. It’s a way to automate part of your decision-making process while still maintaining control over your entry.

How to Place a Buy Stop Order in cTrader by FXPro

If you’re trading with FXPro and using the cTrader platform, placing a buy stop order is quick and user-friendly. cTrader offers an intuitive interface that makes it easy to set up advanced order types like buy stops, even if you’re not an experienced trader.

Follow these steps to place a buy stop order in cTrader by FXPro:

- Open the cTrader platform and log in to your FXPro trading account.

- Search for the instrument you want to trade using the watchlist or the search bar.

- Right-click on the instrument or its chart and select “New Order.”

- In the order window, set the order type to “Stop Order.”

- Choose “Buy” as the direction.

- Enter the price level where you want the buy stop to trigger. This price must be above the current market price.

- Set your stop loss and take profit levels if needed.

- Click “Place Order” to confirm.

Once placed, your buy stop order will remain pending until the market reaches or exceeds your chosen price level. At that point, it will automatically convert into a market order and be executed at the best available price.

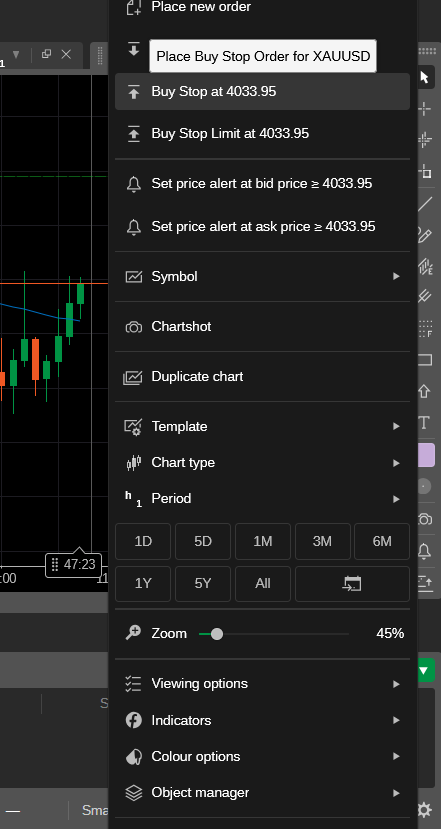

You can also place a buy stop directly from the chart using cTrader’s visual tools. Just right-click on the chart where you want to place an order. Then select Place Buy Stop Order for and click on this section. This makes trade planning more flexible and visually intuitive.

After placing a Buy Stop order, you can also adjust it by dragging it up or down.

Using a buy stop in cTrader allows you to prepare for market moves in advance and react automatically when your conditions are met, without needing to watch the charts constantly.

Example of a Buy Stop Order

To illustrate how a buy stop order functions, let’s consider a practical example using current market levels.

EUR/USD Example

As of October 10, 2025, the EUR/USD currency pair is trading at approximately 1.1700. If you anticipate that a breakout above the 1.1750 level will lead to further upward momentum, you might place a buy stop order at 1.1750.

Here’s how it works:

- Your buy stop order remains inactive while the price is below 1.1750.

- Once the price reaches or exceeds 1.1750, your order is triggered and executed at the next available price.

- You enter a long position, aiming to capitalize on the anticipated bullish movement.

USD/JPY Example

Currently, the USD/JPY pair is trading around 147.25. If you expect that a rise above 147.50 will signal a continuation of the uptrend, you could set a buy stop order at 147.50.

The process is similar:

- The buy stop order stays pending until the price hits 147.50.

- Upon reaching this level, the order becomes a market order and is filled at the best available price.

- You enter a buy position, positioning yourself to benefit from the expected upward movement.

In both examples, the buy stop order allows you to enter the market only when the price confirms your analysis, helping to avoid premature entries and potential false breakouts.

When to Use a Buy Stop Order

Buy stop orders are powerful tools that can help traders enter the market at the right moment, but knowing when to use them is key to maximizing their effectiveness.

Here are some common situations where a buy stop order is useful:

- Breakout Trading

When you expect the price to break through a resistance level and continue rising, a buy stop order allows you to enter the trade as the breakout happens. This way, you avoid entering too early and getting caught in a false breakout. - Momentum Trading

If you believe an asset will gain strong upward momentum after reaching a certain price, placing a buy stop order lets you jump in and ride the wave without needing to watch the market constantly. - Automated Entry

For traders who can’t monitor the markets all the time, buy stop orders offer a way to automate entry. The order triggers automatically once your specified price is hit, so you don’t miss potential opportunities. - Trend Following

Traders who follow trends can use buy stop orders to enter long positions when the price confirms an upward trend by breaking above key resistance or previous highs. - Risk Management with Buy Stop Loss Orders

Sometimes traders combine buy stop orders with stop loss levels to limit risk. This approach ensures that if the market moves against their position, losses are capped.

Remember, buy stop orders work best in markets where price momentum and breakouts are common. In sideways or range-bound markets, they may trigger false signals.

Buy Stop vs Other Order Types

Understanding how a buy stop order compares to other order types can help you choose the right tool for your trading strategy. Below is a simple comparison of buy stop orders, buy limit orders, and market orders:

| Order Type | Entry Price Relative to Current Price | When It Executes | Use Case |

|---|---|---|---|

| Buy Stop Order | Above current market price | When the price rises to or above the stop level | Enter on breakout or momentum confirmation |

| Buy Limit Order | Below current market price | When the price falls to or below the limit level | Enter at a desired lower price, expecting a rebound |

| Market Order | N/A (immediate execution) | Immediately at the best available price | Enter immediately at current market price |

Quick Explanation:

- Buy Stop Order: You place this order above the current price to catch upward momentum once the market breaks a resistance level.

- Buy Limit Order: This is placed below the current price, used when you expect the price to drop first before rising again.

- Market Order: This is an immediate buy at the current price, used when you want instant execution without waiting for price movement.

By choosing the correct order type, you can better align your trades with your strategy and market conditions.

Conclusion

A buy stop order is a valuable tool for traders looking to enter the market at the right moment, especially when aiming to catch breakouts or strong upward momentum. By placing an order above the current market price, you can automate your entry and avoid premature trades that don’t meet your criteria.

Whether you’re trading forex, stocks, or commodities, understanding what a buy stop means and how it works is essential for effective trade execution. Platforms like cTrader by FXPro make it easy to place buy stop orders and manage your trades with precision.

Remember to use buy stop orders strategically, whether for breakout trading, momentum plays, or trend following, and combine them with sound risk management to protect your capital.

With this knowledge, you’re now better equipped to incorporate buy stop orders into your trading plan and take advantage of market movements with confidence.

FAQ

What is a buy stop in trading?

A buy stop is a pending order to buy an asset at a price above the current market level. It triggers when the market reaches or exceeds that price, allowing traders to enter on upward momentum.

What does buy stop mean in forex?

In forex, a buy stop order works the same way—it activates a buy trade once the currency pair’s price rises to the specified level, helping traders catch breakouts or trends.

How does a buy stop order work?

A buy stop order remains inactive until the market price hits the stop level. Then it becomes a market order and executes at the next available price.

What is the difference between a buy stop and a buy limit?

A buy stop is placed above the current price to enter on a breakout, while a buy limit is placed below the current price to buy at a lower level, expecting a bounce.

What is a buy stop loss order?

A buy stop loss order is used to limit losses on a short position by triggering a buy order if the market price rises to a certain level.

Can you give an example of a buy stop order?

If EUR/USD is trading at 1.1700 and you place a buy stop at 1.1750, your order will execute only if the price reaches or exceeds 1.1750, allowing you to enter as the price breaks higher.