Starting out in the financial markets can be both exciting and intimidating. Many beginners wonder how to take their first steps in online trading, which platform to choose, and how to avoid common mistakes in forex trading or other instruments. The truth is, with the right foundation, trading can become a skill that grows steadily with practice, discipline, and education.

One of the most important decisions for any beginner is selecting a reliable trading platform and broker. A good broker not only provides access to the markets but also ensures a safe environment where traders can learn without unnecessary risks. This is where FXPro stands out. Known for its strong regulation, fast execution, and access to a wide range of trading instruments, FXPro is often recommended for beginners looking for a balance of safety and advanced features.

Whether your goal is to explore forex trading, trade global stocks, analyze indices, or diversify with commodities, FXPro gives you all the tools you need under one roof. With platforms like MT4, MT5, and cTrader, the broker offers flexible options that cater to both newcomers and experienced traders, making the learning process smoother.

Step 1: Choose FXPro as your broker

The first step in this beginner trading guide is selecting a trustworthy broker that will support your growth. FXPro has been positively highlighted in many FXPro reviews thanks to its transparency, customer support, and wide selection of trading instruments. By choosing FXPro, you are working with a company that not only provides the tools for trading but also creates a structured and secure environment where you can develop your skills.

With FXPro, you gain access to global financial markets through professional trading platforms. MT4 and MT5 are perfect for those who want to combine simplicity with advanced features, while cTrader offers another option for traders who prefer a modern and intuitive interface. Each of these platforms is designed to help you learn the mechanics of online trading, from opening a chart and applying indicators to placing your first trade.

Selecting FXPro as your broker means you can focus on the learning process without worrying about unreliable execution or lack of security. This allows beginners to dedicate their attention to building a strategy, practicing with different instruments, and studying market behavior. By starting your journey with a safe and regulated broker, you increase your chances of long-term success in forex trading and other areas of the financial markets.

Step 2: Open your trading account

Once you have chosen FXPro as your broker, the next step is to open a trading account. This process is straightforward and designed to give you fast access to the financial markets. To make it easier for beginners, here is a step-by-step guide:

- Visit the FXPro website and click on the option to open a new account. Make sure you are on the official site to ensure your funds and personal information remain secure.

- Fill in your personal information, including your full name, email address, phone number, and country of residence. Accuracy is important because this information will be used for account verification.

- Choose your account type. FXPro offers several options tailored for beginners and professional traders. Review the available accounts and select one that matches your trading experience, risk tolerance, and preferred leverage level.

- Verify your identity by uploading the required documents such as a government-issued ID and proof of address. Verification is a standard step with regulated brokers and ensures the security of your account.

- Set up your trading preferences, including your base currency, leverage, and trading platform (MT4, MT5, or cTrader). These choices will influence your trading experience, so take time to understand which fits your style.

- Confirm and submit your application. Review all the details, agree to FXPro’s terms and conditions, and submit. Once your account is verified, it will be ready for both demo and live trading.

Opening a trading account with FXPro is more than just a formal step. It gives you access to forex trading, stocks, indices, and commodities, as well as the ability to practice with a demo account. Beginners can experiment with strategies, understand leverage in trading, and gradually gain confidence before placing real trades. Following this step-by-step guide ensures a structured start, helps avoid common beginner mistakes, and allows you to focus on learning the fundamentals of online trading.

Step 3: Deposit funds

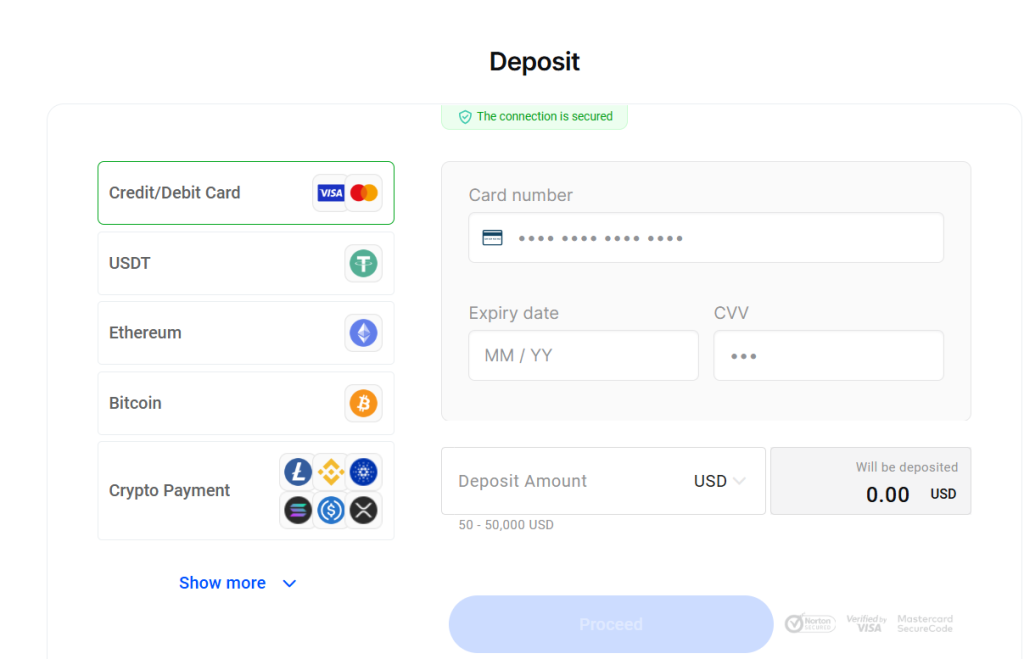

After your FXPro account has been verified, the next step is to fund it so you can start trading. Properly managing your trading funds is crucial for beginners, as it helps you control risk and develop discipline from the very start. FXPro provides several secure deposit methods, making it easy to transfer money safely.

Here is a step-by-step guide to depositing funds:

- Log in to your FXPro account and navigate to the deposit section.

- Choose your preferred payment method. FXPro supports bank transfers, credit and debit cards, and various e-wallets. Selecting a convenient method ensures smooth transactions.

- Enter the amount you want to deposit. As a beginner, it is recommended to start with an amount you are comfortable risking. This helps you gain experience without taking unnecessary financial risks.

- Review any fees, spreads, or commissions associated with your chosen deposit method. Understanding these costs is important, as they affect your overall trading performance.

- Confirm the deposit and wait for it to be processed. Depending on the method, transactions can be instant or take a few business days. FXPro ensures all deposits are secure and processed quickly.

- Check that your account balance has been updated and is ready for trading. Once funds are available, you can begin exploring platforms, practicing strategies, and preparing for your first trades.

Depositing funds is a critical step because it allows you to apply what you have learned on a live account. By starting with a manageable amount, you can focus on understanding market behavior, practicing risk management strategies, and building confidence. This step also highlights the importance of proper fund management, which is a cornerstone of successful online trading.

Step 4: Explore FXPro platforms

Before trading with real money, it is essential to become familiar with the FXPro platforms. Understanding how to navigate charts, use tools, and place orders helps beginners build confidence and avoid mistakes when they start live trading. FXPro offers MT4, MT5, and cTrader, each with unique features suitable for different trading styles.

When you first log in, it is recommended to open a demo account on your chosen platform. Demo accounts replicate live market conditions but use virtual funds, allowing you to practice without any risk. Start by exploring the charts, trying different timeframes, candlestick patterns, and chart types. This helps you understand how price moves and how trends develop over time.

Next, experiment with indicators and tools such as moving averages, RSI, or support and resistance levels. Observing how these indicators behave in different market conditions can help you learn to identify potential trading opportunities. Practice placing different types of orders, including market, limit, and stop orders, so you understand how each one functions. This hands-on experience ensures you can execute trades correctly when you move to a live account.

It is also important to track your practice trades and review the outcomes. By analyzing what worked and what did not, you can refine your approach, improve your strategies, and gain confidence in your ability to trade. Exploring FXPro platforms thoroughly before using real money allows you to focus on learning the mechanics of trading, understanding price action, and managing trades efficiently. This preparation creates a strong foundation for future success in online trading.

Step 5: Learn About Trading

Education is a crucial part of becoming a successful trader. Beginners need to understand the basic principles of market behavior, price action, and risk management before placing real trades. Learning how candlestick patterns, trendlines, and support and resistance levels work can provide practical insights into trading decisions. By combining theory with practice, you can develop a systematic approach that reduces emotional mistakes and improves consistency.

Reading strategies and examples can help you understand how markets react in different conditions. Observing real charts and seeing how patterns unfold allows you to avoid common beginner mistakes, such as overtrading or ignoring stop-loss levels. Alongside this, focusing on risk management techniques ensures that every trade is planned and that losses are controlled.

Trading Strategies for Beginners

One of the first strategies to learn involves candlestick patterns. A shooting star can indicate a potential reversal after an upward movement, signaling that selling pressure may increase.

On the other hand, a hammer pattern often appears after a downtrend and can signal that buyers are starting to regain control, providing a potential entry point for a long trade.

Technical indicators also play an important role. The Relative Strength Index (RSI) helps identify overbought or oversold conditions.

When RSI shows overbought levels, the market may be due for a pullback, while oversold levels can indicate potential buying opportunities.

Combining RSI signals with candlestick patterns can improve the reliability of trade decisions.

In addition, using moving averages such as the SMA50 can help identify trend direction and potential support or resistance levels. When price is above the SMA50, the trend is generally considered bullish, while a price below it may indicate a bearish trend. Integrating SMA50 with candlestick patterns and RSI readings can provide a more complete view of market conditions, allowing beginners to make informed trading decisions.

By focusing on these strategies, beginners can start to recognize market patterns, apply risk management, and gradually build confidence. Learning from real examples, combining multiple indicators, and practicing regularly lays the foundation for consistent and disciplined trading.

Step 6: Try the Demo at FXPro

Practice is one of the most important steps for beginners before trading with real money. FXPro provides a demo account that replicates live market conditions while using virtual funds, allowing you to experiment without any financial risk. This experience helps you understand how the markets move, how to apply strategies, and how to manage trades effectively.

Using a demo account allows you to test different trading approaches, including candlestick patterns, RSI signals, and SMA50 trends, while seeing how they perform in real-time conditions. You can observe how the market reacts to news, how volatility affects trade outcomes, and how spreads and commissions influence results. By simulating real trades, you gain confidence in your ability to analyze charts and make informed decisions.

Practicing on a demo account also helps reinforce risk management strategies. You can test different stop-loss and take-profit levels, experiment with position sizing, and observe how emotions like fear or overconfidence affect your decisions. This allows you to develop discipline and a structured approach before committing real funds.

The demo account is not just a tool for testing strategies; it is an essential learning environment. By spending time in a risk-free setting, beginners can refine their techniques, track performance, and gradually prepare to transition to live trading. Regular practice ensures that when you are ready to place real trades, you are confident, disciplined, and well-prepared to navigate the financial markets.

Step 7: Place Your First Trade

After practicing on a demo account and gaining confidence with charts, indicators, and strategies, it is time to place your first real trade on FXPro. Starting small is key for beginners, as it allows you to focus on learning and applying proper risk management rather than chasing immediate profits. Understanding how to manage emotions, maintain discipline, and follow your strategy is more important than the outcome of a single trade.

Before entering a trade, review your analysis carefully. Look for confirmations from candlestick patterns, such as a hammer or shooting star, check RSI levels for overbought or oversold conditions, and consider the position of the price relative to SMA50 to determine the trend. Setting stop-loss and take-profit levels ensures that your risk is defined and that losses are limited. This structured approach helps protect your capital and builds good trading habits from the start.

Once the trade is placed, monitor its progress without letting emotions dictate your decisions. Avoid moving stop-loss levels impulsively or increasing your position size out of overconfidence. Keeping a trading journal to record your entries, exits, and observations can help you review performance and refine strategies over time. Learning from each trade, whether it results in profit or loss, is essential for developing consistent trading skills.

Placing your first trade marks a significant milestone in your trading journey. By combining preparation, strategy, and risk management, you can approach the financial markets with confidence. With patience, practice, and discipline, each trade becomes an opportunity to improve, making your experience with FXPro both educational and rewarding.

Conclusion

Starting your trading journey with FXPro provides beginners with a safe and structured environment to learn, practice, and grow. By following the steps of choosing a broker, opening an account, depositing funds, exploring platforms, learning trading basics, practicing on a demo account, and placing your first trade, you can build a solid foundation for long-term success.

Trading is a skill that develops over time through patience, education, and hands-on experience. Each step in this guide is designed to help you gain confidence, understand market behavior, and apply risk management strategies effectively. Using FXPro’s tools and resources, such as MT4, MT5, cTrader, demo accounts, and access to a wide range of instruments, allows beginners to practice and refine their approach before committing real funds.

Remember that discipline is key. Managing emotions, following your strategy, and learning from both successes and mistakes will help you grow as a trader. No single trade determines your overall success; consistent practice, careful analysis, and structured decision-making are what lead to long-term profitability.

By combining education, practical experience, and the support of a regulated broker like FXPro, beginners can confidently navigate the financial markets. Taking the time to learn, practice, and apply strategies thoughtfully ensures that your trading journey starts on the right path and continues with steady improvement.